By RG Partners

Rwanda’s surprise interest-rate cut is reshaping the financial system, softening yields across markets while leaving banks bracing for tighter margins in the months ahead.

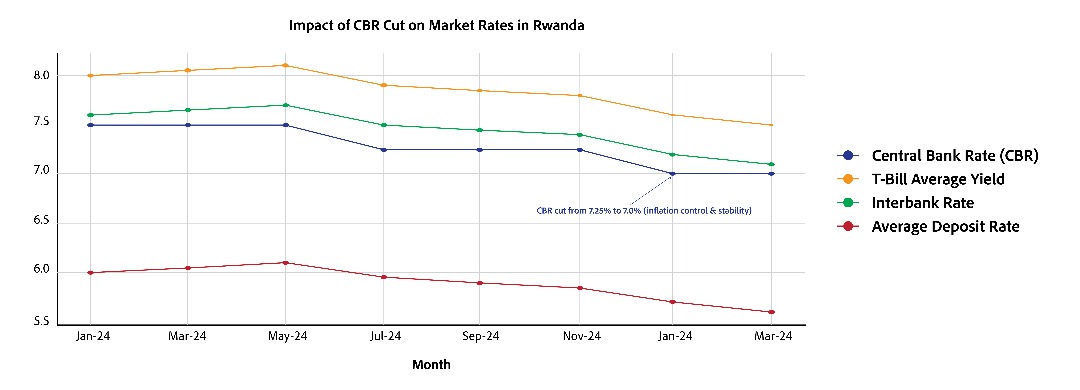

The National Bank of Rwanda’s decision to lower the Central Bank Rate earlier this year was aimed at easing inflationary pressures and stabilizing growth. But as with any shift in monetary policy, the effects are cascading unevenly. Interbank lending rates have cooled, Treasury bill yields have softened, and deposit pricing is adjusting more slowly, leaving lenders with thinner cushions on interest income.

Pressure on Bank Income

For banks that rely heavily on government securities and short-term placements, the squeeze is already clear. Yields on Treasury instruments have moderated, curbing returns just as deposit obligations, often locked in fixed-term agreements remain sticky. That imbalance could erode net interest margins in the FY of 2025, particularly for institutions with limited loan book expansion.

While lower deposit costs may eventually filter through, the lag between declining yields and funding expense adjustments means banks face a period where their revenue lines contract faster than their costs. It’s a classic interest-rate compression cycle, and in Rwanda’s relatively concentrated banking sector, those most dependent on passive investment income will feel it most.

Shifting Strategy

To offset margin pressure, lenders are expected to accelerate the shift toward non-interest revenue. Fee-based services, digital banking platforms, and transaction income will become increasingly critical to sustaining profitability. Strategic management of maturities on both assets and liabilities will also be key to navigating the new environment.

At the same time, the temptation to chase loan growth may prove strong, with cheaper funding making credit expansion more attractive. But lenders will have to strike a careful balance: pursuing growth without underestimating default risks in an economy still exposed to external shocks.

What It Means for Customers

For depositors, the impact will be equally visible. Rates on savings and term deposits are likely to trend lower, eroding returns for households and corporates. Savvy savers will be under pressure to review products, renegotiate terms where possible, or consider alternatives in capital markets.

The adjustment highlights how monetary policy shifts are not just abstract levers pulled by technocrats in Kigali, but forces that shape everyday financial decisions from the returns on a family’s savings to the strategies deployed in bank boardrooms.

Eye on Tomorrow: MPC Decision Looms

All eyes are now on tomorrow, August 21, 2025, when the National Bank of Rwanda’s Monetary Policy Committee will announce the new bank rate in a press conference.

Market watchers expect the MPC to maintain the current easing stance, given the ongoing need to support growth amid subdued inflation readings. But observers are equally attentive to the tone of forward guidance. Will policymakers signal further cuts ahead, or shift toward signaling a pause to monitor emerging domestic and regional dynamics? The statement and press briefing will offer crucial insight into how the central bank views inflation risks, exchange-rate pressures, and financial stability in the coming quarter.

Bottom Line

The central bank’s move illustrates the double-edged nature of monetary easing. While cheaper credit supports economic activity, it threatens to erode the earnings of banks that form the backbone of the financial system. Adaptability, for institutions and customers alike will be the difference between weathering this shift and being caught on the wrong side of Rwanda’s new interest-rate cycle.