Rwanda is poised to consolidate its economic gains and advance a bold reform agenda after posting 8.9 percent growth in 2024, driven by a recovery in agriculture and continued strength in services and construction, the International Monetary Fund said following the conclusion of its fifth review under the Policy Coordination Instrument.

The IMF praised Rwanda’s strong macroeconomic performance and policy discipline, pointing to the government’s steady progress on structural reforms, improved governance of state-owned enterprises, and growing momentum on climate finance initiatives.

“Rwanda’s economy has demonstrated impressive resilience, recording strong growth supported by robust activity in the services, construction, and agriculture sectors,” IMF Deputy Managing Director and Acting Chair, Bo Li said. “Inflation has remained within the NBR target range, aided by prudent monetary policy and improved domestic food supply,” he added.

With inflation contained within the central bank’s 2–8 percent target band and international reserves at a comfortable 4.7 months of import cover, the Fund said Rwanda is well positioned to navigate near-term pressures, provided fiscal discipline is sustained and reform implementation continues.

All quantitative targets under the PCI were met, and most structural benchmarks were completed, including reforms in public financial management digitalization, monetary statistics, and SOE oversight. The authorities also continued to make strides on climate-related reforms, with the rollout of climate budget tagging and efforts to develop a green taxonomy and pipeline of investable projects.

The IMF welcomed the recent adoption of a comprehensive tax policy package, which it said will broaden the tax base and improve equity and efficiency. It underscored the importance of accelerating domestic revenue mobilization to create space for priority spending, while maintaining a credible fiscal consolidation path.

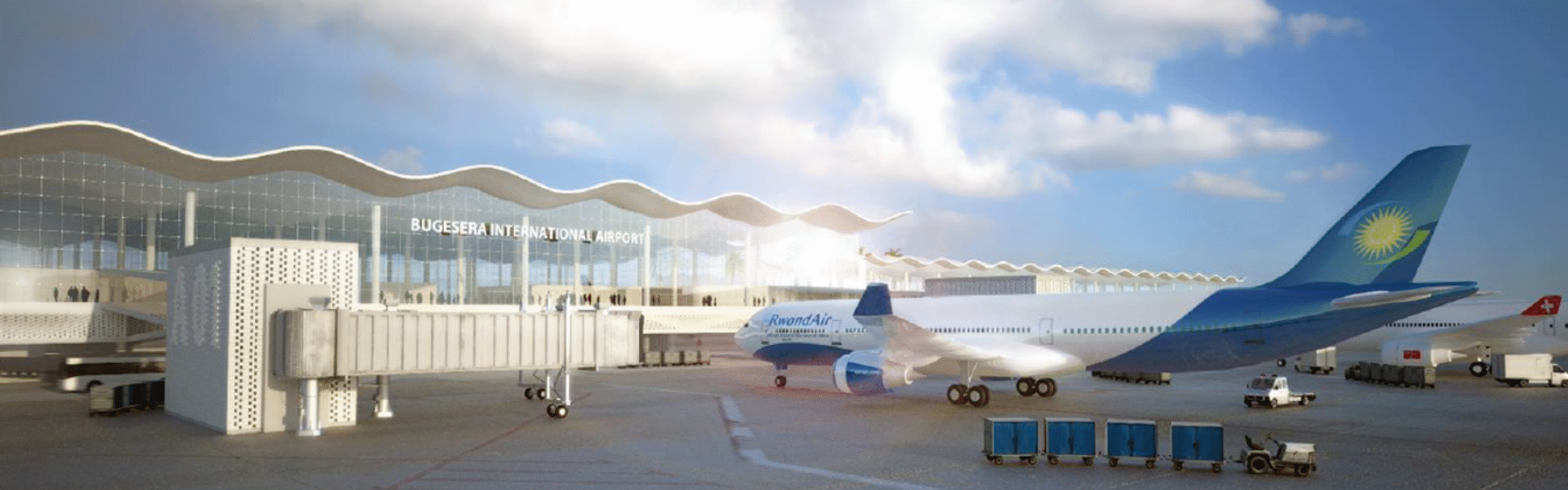

Still, the Fund flagged rising fiscal pressures stemming from large infrastructure investments, most notably the New Kigali International Airport and RwandAir’s expansion, as well as the fiscal implications of recent pension reforms. Public debt is projected to peak in fiscal year 2025/26, with Rwanda expected to reach its PCI debt anchor in 2033.

“Sustaining fiscal consolidation remains vital to preserving macroeconomic stability and ensuring debt sustainability,” Li said. “Continued expenditure rationalization and close monitoring of fiscal risks, particularly from SOEs and the ambitious priority investment project, are essential.”

Monetary and financial policy should remain focused on price and external stability, the IMF said, urging vigilance against inflationary pressures and endorsing greater exchange rate flexibility to absorb shocks. Credit oversight, particularly in the microfinance sector and large exposures, should be strengthened to safeguard financial stability.

The IMF concluded that Rwanda’s reform path remains strong and forward-looking, and that continued engagement with development partners and private investors will be key to unlocking green finance and achieving the country’s long-term development objectives.