Rwanda’s banking industry has experienced significant profitability growth over the past decade, according to the latest State of the Banking Industry Report by the Rwanda Bankers Association. The report highlights a consistent increase in profitability, aligned with the country’s robust economic performance, except for the COVID-19 period.

The average return-on-equity (ROE) remained stable between 10.0% and 15.0% from 2014 to 2020 but surged to 21.5% by September 2023. Similarly, the average return-on-assets (ROA), which had been between 1.7% and 2.3%, climbed to 4.7% over the same period.

Three key factors underpin this profitability trend: a cautious industry approach, ongoing investment in efficiency, and stable net interest margins. Despite net interest margins staying within the 8.0% to 10% range, yields on advances have declined from 17.3% in March 2014 to 11.4% in September 2023.

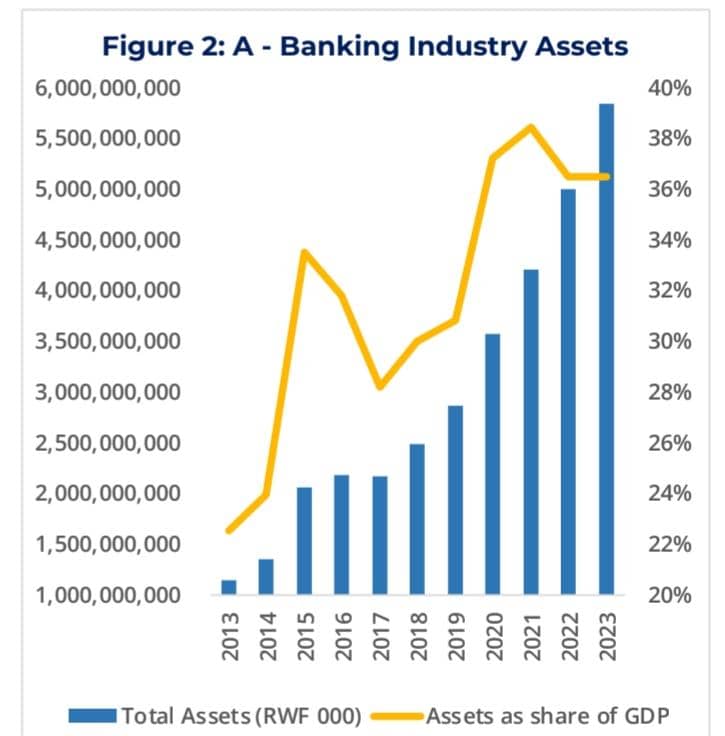

This profitability increase, coupled with stable net interest margins, indicates steady growth in advances, highlighting the noticeable upward trajectory of banking industry assets. The decline in the average lending rate, as seen in the yield on advances, reflects banks’ strategy of shifting their portfolio towards less risky assets.

Chief Executive Office of Rwanda Banker’s Association, Tony Ntore highlighted that the report represents the collective effort and dedication of the newly established Research Centre and the invaluable contributions from members’ banks.

“The steady growth in profitability demonstrates the resilience and strategic adaptability of Rwanda’s banking sector, even in the face of global economic challenges.”

This report underscores the sector’s strength and its role in supporting Rwanda’s economic growth, making it an attractive destination for investment in the banking industry.